“Unlike cryptocurrencies, a CBDC isn’t a commodity or claims on commodities or digital assets. Only its form is different.”īut a CBDC can’t be exactly compared to cryptocurrencies. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Cryptocurrency Vs Digital RupeeĪccording to the RBI, “a CBDC is a legal tender issued by a central bank in a digital form. Cyberattacks are probably increasing and can also threaten digital currency users with virtual theft. The digital currency has made people constantly worry about cybersecurity and facing many threats due to less secure methods to store this money. For the wide adoption of digital currencies, the system needs to be simplified.

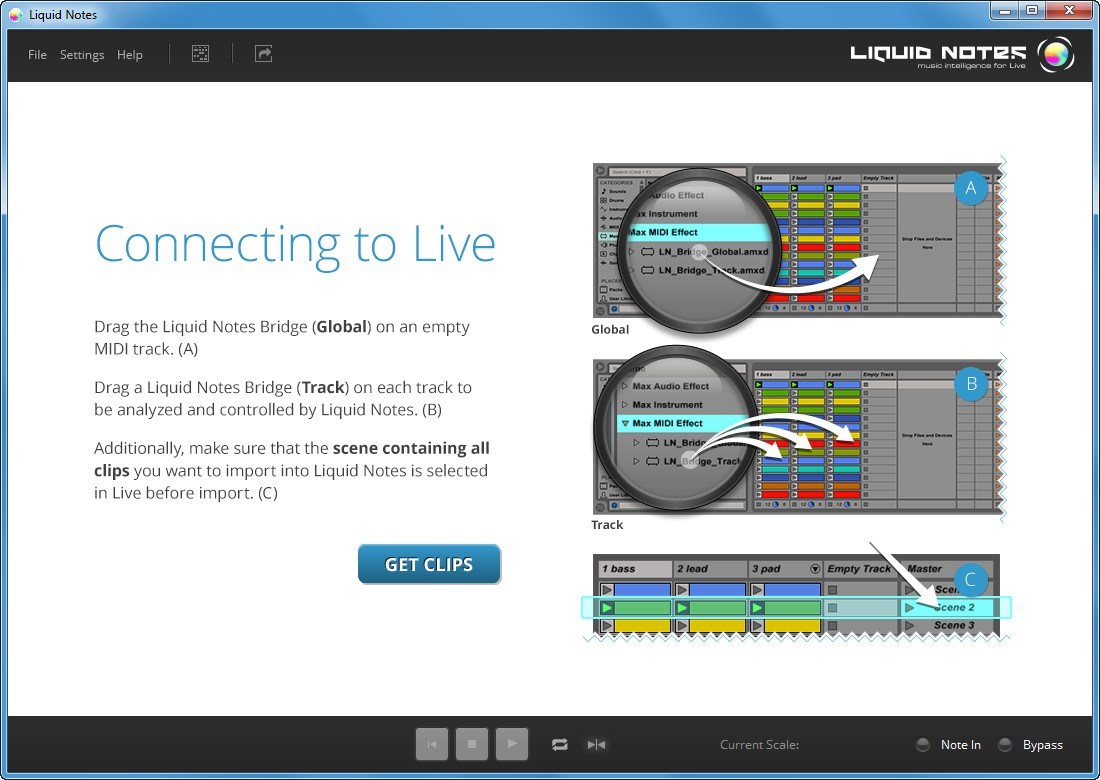

Similar to liquid notes how to#

On the part of the user, digital currencies require work to learn fundamental tasks like how to open a digital wallet and securely store digital assets. However, this would probably not exist for the central bank of digital currencies as complex consensus processes are not required and CBDC would likely oversee it. This in turn takes a significant amount of electricity, the more the transaction the more the expense. Costly TransactionĬrypto uses blockchain technology where computers must resolve complex equations to validate and record transactions. It will take a certain amount of time to decide which digital currencies in certain cases might be appropriate to use.It also includes whether a few are designed to scale for mass adoption. According to the head of Sidley’s FinTech and Blockchain group Lilya Tessler, across different blockchains, there are several digital currencies being created with their own limitations. Here’s a list of some drawbacks of digital rupee: Options What Are The Disadvantages Of Digital Rupee? If the government developed a central bank of digital currency, it could send payments like child benefits and food stamps, and tax refunds to people instantly, rather than trying to figure out prepaid debit cards or mail them a check. Also, digital currencies are immune to soiling or physical defects that are present in physical currency. Whereas, in digital currencies, no such expense is involved. Physical currencies have many requirements such as the establishment of physical manufacturing facilities. On the other hand, existing money transfers frequently take more time during weekends and outside normal working hours because banks are shut and cannot confirm transactions. 24/7 Availabilityĭigital currency transactions work at the same speed i.e.

Digital assets could interrupt this market by making the transaction cost-effective and quick. Individuals are charged high fees to move funds from one nation to another, especially when it includes currency conversions. Cheaper Global TransfersĪt times global transactions can get very expensive. Here are some of the advantages of digital currency: Faster Mode of Paymentĭigital currency can make your payments much faster than current means like automated clearing houses or wire transfers that take days for financial institutions to confirm a transaction. What Are The Advantages Of Digital Rupee? According to CoinMarketCap, the availability of cryptocurrencies is more than 21,000.

The foundation of cryptocurrency is provided by blockchain technology which is the most usual form of distributed ledger used by digital currencies. The three major varieties of digital currency are cryptocurrency, central bank digital currency (CBDCs) and stablecoins. Digital currency, however, is exclusively exchanged through virtual means and does not leave a computer network. Currencies’ electronic types already predominate a large number of nations’ financial systems. What Is Digital Rupee?Ī digital currency is any currency that is available entirely in electronic form. The digital rupee is the RBI’s accepted version of cryptocurrencies, which the central bank has dismissed repeatedly and called a serious challenge to the stability of the financial system of the country. Commonly known as the digital rupee, it will be exchangeable at par with existing currencies and will be considered acceptable for payments and a safe store of value.Īlso being called the e₹ or the digital rupee, CBDC issued by the RBI is aimed at creating an additional option to use money and isn’t very different from the currently-issued banknotes only the digital rupee is expected to be transacted digitally and facilitate ease of use. The Reserve Bank of India is set to launch the pilot of its central bank digital currency (CBDC), which it categorizes as legal tender in a digital form.

0 kommentar(er)

0 kommentar(er)